The Collapse of Cryptocurrency

A former-billionaire brought the downfall of cryptocurrency

Share this story

Cryptocurrency magnate Sam Bankman-Fried (SBF), the disgraced former-billionaire CEO of FTX and Alameda Research, has been arrested in The Bahamas and extradited to the United States on charges of wire fraud, securities fraud, money laundering, and embezzlement, among others. SBF was raised in Stanford, California, by two Stanford University professors of law. He attended the Massachusetts Institute of Technology (MIT) from 2010 to 2014 and got his start on Wall Street before creating Alameda Research in 2017, later founding FTX with business partner Gary Wang in 2019.

Alameda Research was founded as a quantitative cryptocurrency trading firm, amassing large holdings in digital currencies like Bitcoin (BTC) and Ethereum (ETH). Two years later, FTX was founded as a trading platform for investors and eventually became the third-largest platform in the world with over one million active users in the United States. While serving as the CEO of FTX, SBF maintained a 90% holding in Alameda Research. In early November 2022, Coindesk reported that Alameda Research was largely built upon holdings in FTT, FTX’s native token. It was later revealed that Bankman-Fried had secretly diverted billions of dollars in client funds to Alameda Research. As said in the Securities and Exchange Commission (SEC) complaint against Bankman-Fried, he used Alameda Research as his “piggy bank,” loaning himself client money to make political donations and buy real estate in The Bahamas. During the 2022 midterms, SBF reportedly donated over $40 million to Democratic candidates; additionally, he admitted to donating to Republicans through dark money channels. “All my Republican donations were dark,” said SBF during an interview with YouTuber Tiffany Fong. “Reporters freak out if you donate to Republicans.” It has been estimated that SBF donated an additional $40 million to Republican candidates during 2022, all through client funds. In wake of the controversy, Binance CEO Changpeng Zhao pulled the $2.1 billion FTX investment made by his company in 2019. Binance, the largest cryptocurrency exchange in the world, was an early investor in FTX and maintained the relationship until, as said by Zhao via Twitter, “recent revelations came to light.” The loss of Binance’s investment led to investors pulling nearly $6 billion from the company in three days. Within a week, FTX and Alameda Research had declared bankruptcy.

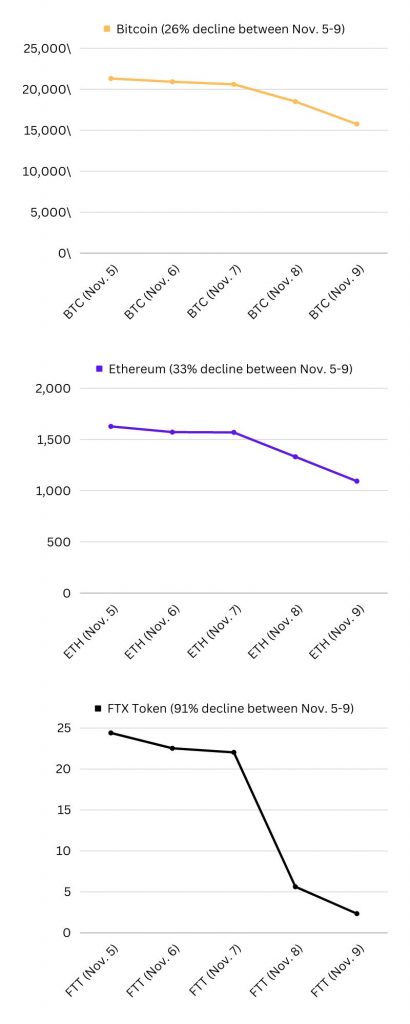

The bankruptcy of the world’s third-largest cryptocurrency exchange led to major downturns in several major digital currencies. Declines in Bitcoin (BTC), Ethereum (ETH), and FTX Token (FTT) between November 5th and November 9th are highlighted in the provided infographic. As of January 2023, cryptocurrency prices rest at the lowest prices in years, along with a low public perception. The SBF case has opened doors for heavy criticism and logical questioning from news providers and private citizens alike. Will cryptocurrency prices ever bounce back? Are other major trading platforms engaging in illegal activity? Is it really a smart investment?

Cryptocurrency is purported to be popular among members of the younger generations. Millennials and Gen Z make up 94% of investors; however, a high percentage does not amount to a high number. Students of our school do not have notably high opinions on cryptocurrency. “I do not view cryptocurrencies as a safe investment,” said junior Cameron Roach. “There’s no future where they’ll be widely used.” Sophomore Will Howg shares a similar opinion. “I feel like a lot of people have lost a lot of money to cryptocurrency,” said Howg. “And me personally, I’m not about to lose money to crypto.” Senior Caitlin Como sees cryptocurrency as an unnecessary risk. “Since it’s already losing value, I would probably choose not to invest,” said Como. While it is true that most of the cryptocurrency’s popularity is rooted in younger generations, the average young person is not interested.

Cryptocurrency has been a noteworthy trend, but a variety of factors are contributing to its demise. The arrest of Sam Bankman-Fried has brought widespread negative attention to digital currencies, showing people around the world that they may not be a wise investment. When his trial begins on February 8, 2023, SBF will face 115 years in federal prison.